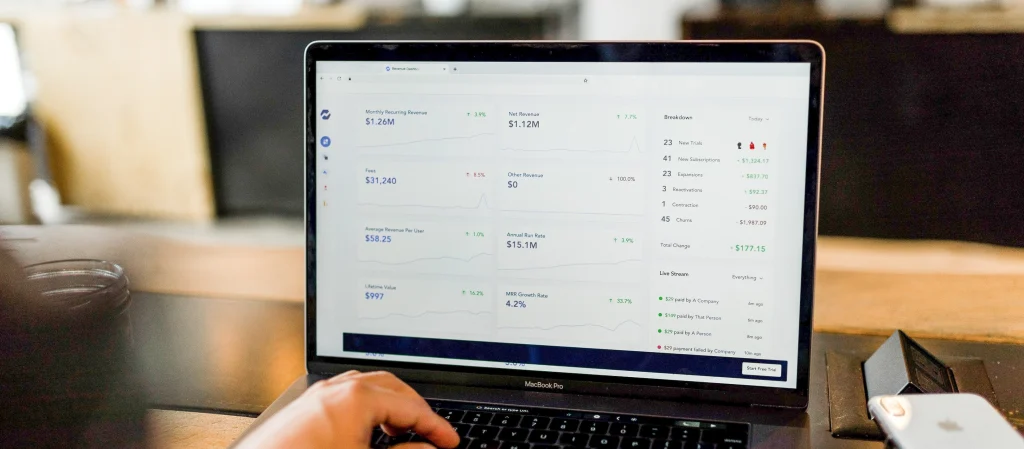

Don’t follow the crowd. That’s one of the things we talked about last time, when we took a look at GameStop’s stock. And this is why… Since last August, the video game company has seen a lot of price swings. It went from less than $10/share back in August to over $400/share in January. A month later, and shares dropped to around $40. And now, they’re trading around $260/share. It’s been a roller coaster for GameStop. While you could’ve made a nice chunk of change if you bought and sold shares at the right time, there are plenty of examples of investors who lost a lot of money betting on GameStop… simply because of all the hype. But when done right, investing is something we all should be doing. It’s never too early or too late to start. But there are different ways to invest. We talked about exchange-traded funds (ETFs) and mutual funds last time. The money you invest in a fund goes further with a smaller amount of money. As I explained before, these funds hold a basket of stocks. Some of them hold hundreds of different stocks at a time. So, a drop in the price of shares in one of those stocks would feel like nothing to you. That’s also why investing in ETFs/mutual funds means less risk, too. (Take a look at the chart I showed last time, if you want to see how.) But if you want to invest in individual stocks, there’s one thing to consider…

Your Net Worth Now, everyone’s financial situation is different. Some of us can afford to invest in ETFs/mutual funds; and some of us can afford to invest in stocks, as well. How do you know what you can afford? First and foremost, since everyone is different, the best thing to do is get advice from a financial advisor—someone who’s licensed to recommend the right investments for you and your current situation. But generally speaking, you know you may be able to invest in stocks if:

- You have no debts (this doesn’t include a mortgage).

- You have enough saved up. Enough for you (and your family), if you spend the next three to six months looking for a new job.

- You have a higher net worth.

Net worth basically means everything you own minus everything you owe. For everything you own, think cash in your bank account(s), investment accounts such as a 401(k) or IRA, or any items of value. If you don’t make any loan payments for the car you drive, that counts. And if you own your home, even if you still pay your mortgage, that counts, too, as long as your home is worth more than what’s left on your mortgage. For everything you owe, think credit card balances, student loans, a mortgage, car loans, and other personal loans. Once you know what you own versus what you owe, do the math. So, if you have no debts, besides a $100,000 mortgage on your home, and you have enough in your bank account to pay next month’s bills, if your home is worth $350,000, your net worth is around $250,000. If you have a $10,000 credit card balance, $100,000 in student loans, $5,000 left on your car note, and a $100,000 mortgage left on your home (still worth $350,000), your net worth would be $135,000. If you have no debts at all (meaning no mortgage or car payments, either), and you have $1,500 in your bank account, $1,500 worth of valuable items, and a car worth $5,000, your net worth would be $8,000. If you have a $10,000 credit card balance and $1,500 in your bank account, your net worth would be -$8,500. (I’ll come back to this.)

How Much Is Enough? So, if you just calculated your net worth, is the number you’re looking at enough for you to go one step further than ETFs/mutual funds and invest in stocks? Just remember that you are different from the next person. If your net worth is over $250,000 only because of the value in your home, it may not be enough to invest. If your net worth is $250,000 because of how much your home is worth and you have more than three to six months’ worth of living expenses in your bank account, maybe that is enough for you. On the other hand, if your net worth is $250,000 but you have $10,000 in credit card debt, it may seem like enough, but it’s best to pay off the debt first. (Remember, debt steals from you.) The bottom line is: Your situation is different from everybody else’s. If your net worth is $300,000, you have plenty of savings, and you have no debts, are you willing to say you have enough to face the risks? If you’re willing to invest, $10,000 into stocks, and let’s say their value dropped by 50% all the way down to $5,000, would you say losing $5,000 was worth the risk? If your answer is yes, then you may be ready to speak with a financial advisor about whether investing in stocks is right for you. If your answer is no, then there’s nothing wrong with asking your advisor for more advice. Everyone’s situation is different. And everyone’s risk tolerance is, too. No number you see for your net worth is “enough.” Enough means something different to the next person. Speaking of which…

What Really Matters In life, we get so caught up watching what everybody else has, that we never believe what we have right now is enough. We want the newest phone, the fanciest car, the trendiest name-brand clothes, the luxurious vacation, and on, and on, and on. That’s why 80% of us in the U.S. are in debt. And some of us are even in the deep red. Like the example above, where I said if you have a $10,000 credit card balance and $1,500 in your bank account, your net worth would be -$8,500. If you have a negative net worth, the first thing you should do is take a deep breath. Then, remind yourself you’re only human. Then, read “The Path to Freedom Starts With a Plan,” “How to Cut Back,” and “Save First.” They’ll help you start fresh. Next, just worry about you. If you’re digging yourself into a deeper hole because of the people around you, stop listening to their opinions, stop watching how they live, and stop worrying about what they think about you. We live above our means to prove to everybody around us that we can afford to… when we really can’t. As long as we’re focusing on the materials things of this world, which are all temporary, we’ll never have enough. One of the most sobering thoughts to me is realizing that nothing sitting outside my home, inside my home, or in the bank will be coming with me to my grave. And when I’m gone, nobody is going to say, “Well, you know, she did have a really nice car,” or “She had a lot of really nice, expensive things, though. I’ll give her that.” None of it matters… Not if it isn’t used to make the right impact on others’ lives. I have to remind myself all the time that, as long as I have a roof over my head, food to eat every day, clothes to wear, and a way to get from point A to point B, I already have enough (materially) for myself. I just need to get to the point where “enough” means, I’m free to stop worrying about how I’ll afford this and that and start taking the time to listen to somebody who needs to talk… to love somebody who feels alone… to give to somebody who needs help. So, don’t lose your soul over your net worth. Instead, get motivated by all the opportunities financial freedom can open for you. Freedom from lenders. Freedom to lend an ear. And freedom to give to each other. We’re so much better when we share enough of our gifts, our help, our resources, our time, and our love with each other. And we’re better when the people we meet say, “Thank You, Jesus. They’re in my life for a reason.” And we’re better when others remember the way we treated them—like family.

With gratitude,

Melody C. Kerr, MS

Certified Financial Coach

P.S. If you want to get started on your path to financial freedom, you can schedule a session with me right here.