By Melody C. Kerr, MS, Founder

Writer, Editor, Financial Coach

When I mentioned tax season last month, I shared some good news. Typically, most of us would’ve already filed our taxes by now (unless the IRS granted you an extension). But this year, we get an extra month to file. May 17. That’s the new deadline to file. So, if you still haven’t done your taxes, you still have plenty of time to do so. And if you need more time than that, remember you can file an extension. But like I said before, don’t put it off ’til the last minute. Rushing makes it easier for a mistake or two to creep in and mess up your finances—and your day. I encourage you to work on your taxes and get them out of the way. And while you’re at it, here are a few tips…

Make a Mental Note

These things may also help you prepare for tax season next year. So, make a mental note and write these things down, so you won’t forget. 1. A third stimulus check. Whether you were eligible or not, I know hearing about the third stimulus probably comes as no surprise. But they don’t all directly apply to filing taxes for 2020. Now, the first stimulus checks were approved toward the end of March 2020. And even though many received their second stimulus in January of this year, they were actually approved in late December. Then, the third stimulus was approved on March 11, 2021. If you received all three, don’t report the most recent one. Only the first two were approved last year, so those are the only two you should report. You’ll report receiving the third check when you do your taxes next year. But remember: They’re not considered taxable income. And if you didn’t get a check or direct deposit, and you believe you should have, there is a Recovery Rebate Credit you can claim while you’re doing your taxes. 2. The W-4 Update The IRS updated the W-4, the “withholding” form. I discovered this a little over a year ago, when I was trying to figure out how much I’d get refunded or owe. It no longer gives you an option to increase or decrease your allowance. But don’t jump to any conclusions yet, because it could work out better for you. Here’s what I mean… If you usually get back a good chunk of change after taxes, that means the IRS was withholding too much from your pay. By using the most recent W-4, you may be able to walk away with more of your paycheck every pay period than before. Say, you’re a single person in Florida making $35,000/year. The difference between using the old W-4 and the most recent one would be about $40 per paycheck…

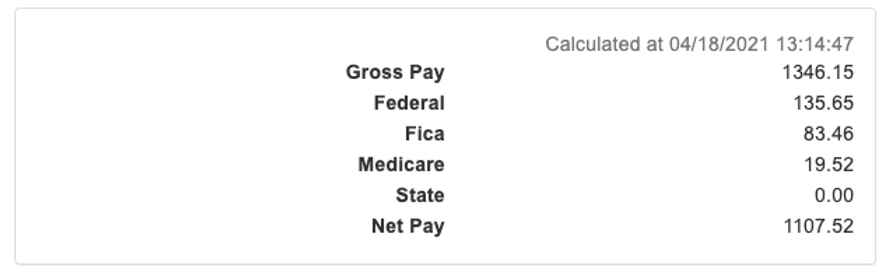

Net Pay with Previous W-4

Net Pay with Updated W-4

Source: Bankrate.com

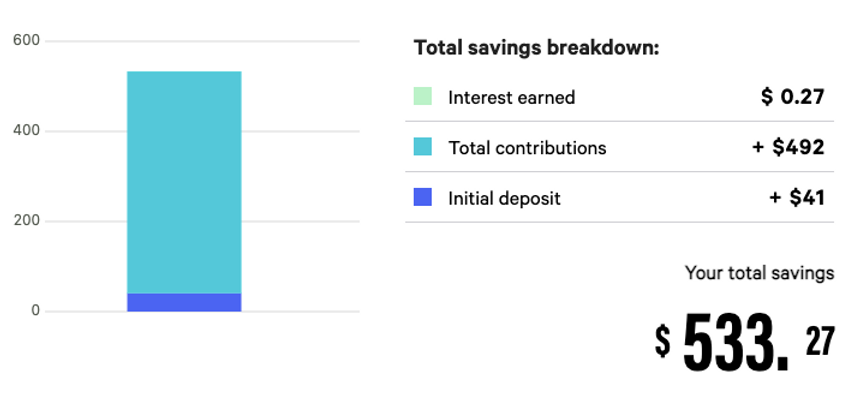

As you can see, the first image shows a paycheck of $1,107.52; and the second one shows a paycheck of $1,147.21. This doesn’t include health insurance, 401(k) contributions, or anything like that; so it may not be an entirely clear picture for you, if that’s your salary. But the point is, using the most recent W-4 may let you take home more of your pay. Now, if you like the thought of always getting something back after you file, like $500 (or whatever that refund is for you), think about this: That money you just got back could’ve gone to better use. Maybe toward a flat tire… maybe toward birthday gifts that always seem to pop up… or maybe toward the “rainy day fund” you’re building… Remember, the money many of us get back is a refund. That means it’s money that already belongs to us in the first place… Money we are owed. And $500 given back in 2021 stays $500. Even with the way interest rates have gone down over the past year, had that $500 been split up evenly and deposited into a savings account each month last year, it would’ve grown to $533 by January 2021. And that’s with only earning 0.1%. See for yourself…

Source: Bankrate.com

3. Plan for Next Year The change to the W-4 may even help you on the other hand, too—if you usually owe money. So, don’t overlook that. And if you’re unsure of how it could impact you, or if you’re unsure about anything regarding your taxes, the best thing to do is reach out to a professional. But the main point is that you can plan for next tax season. We know taxes are due around the same time each year. Don’t put off all the stress until then. Last thing: Don’t forget, there are a few options you can use to file for free. You can check those out right here. If you see something when you do your 2020 taxes this time around, plan for it in your budget this year, so you’ll be ready the next time around. It may just be a matter of changing a couple things within your finances that would help you out come next year. And a tax professional may help you do that. Especially because they’re the experts. So, they know what should work best for your situation. And if you need help planning your budget for next year, you can always reach out to me.

With gratitude,

Melody C. Kerr, MS

Writer, Editor, Financial Coach