We’ve gone over renting vs. owning and which one is the better option. So, we know that the answer isn’t so cut and dry. It really depends on your situation. Before you decide that owning a home and paying a mortgage is a better bet than renting, think about your other debts and how much savings you have first. If you have enough saved for three to six months of living expenses and no other debts, then you may be ready to afford a mortgage, if you choose to go that route. But there are a few other important things besides savings and debt to think about and prepare for before taking that step toward homeownership…

The Down Payment If you were thinking about saving up to put a down payment on a $450,000 home, do you know how much you’d need to save? This is important, because we have to remember that, not only is the home you live in supposed to be your shelter, but most of the time, its value will appreciate. So, not only does it provide a roof over your head, but it can also serve as an asset that increases your net worth. (Net worth is calculated by taking how much you own minus how much you owe.) Remember that, although the value of a place typically increases over time, there are periods where its value may decrease. The smaller your down payment is, the less equity you have in your home. That means if you owe $420,000 on a home that was worth $450,000 when you purchased it, your equity would be $30,000. But if the value of the home drops to $430,000 a year later, you now only have a little more than $10,000 equity. And if it dropped to $415,000, you’d have negative $5,000 equity, meaning an underwater mortgage (owing more than the home is worth)—and $5,000 less net worth. So, how much should you put down? To be very clear, you can and will find lenders, including governmental lenders such as the Federal Housing Administration, that only require smaller down payments. The 3.5% and 5% down payment minimums are common. But just because you can, it doesn’t mean you should. That’s not just for buying a home. That applies to many things in life. Some lenders will require a 10% down payment minimum, which is better. But you’d still be paying more toward your mortgage every month because of private mortgage insurance (PMI). PMI is insurance for the lender, in case you are unable to make your mortgage payments down the line. Basically, they’re protecting themselves, because they are afraid your 10% down payment makes you a riskier borrower. And because of that, they want you to pay more out of your pocket. So, a 20% down payment is the minimum to shoot for. That would be $90,000 on a $450,000 home. Not only will you keep more money in your pocket, but you also are less susceptible to the housing market if it tanks.

The Monthly Minimum Payment The other thing to think about before taking that step toward homeownership is the minimum payment. This is where living within your means comes in… First of all, just like you will find lenders who will let you buy a house with just 3% down (or $0 down if you’re a veteran), you will also find lenders who will let you buy one that’s as much as six times your income. But again, just because you can, it doesn’t mean you should. I like to underestimate rather than overestimate. So, I’m going to use a generally modest example. I know it will drive home (no pun intended) the point I’m trying to make.

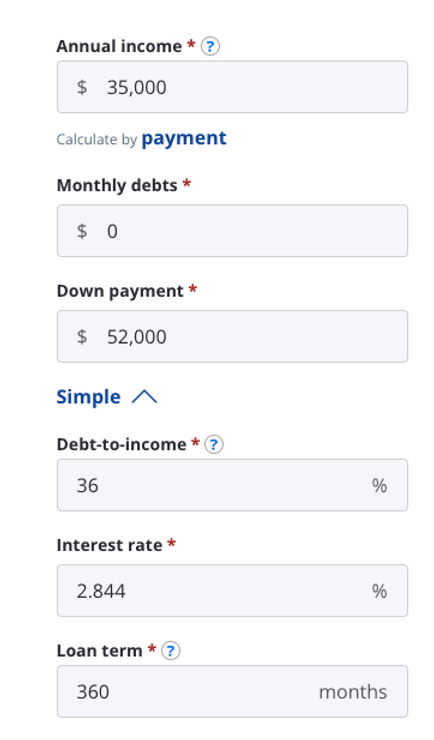

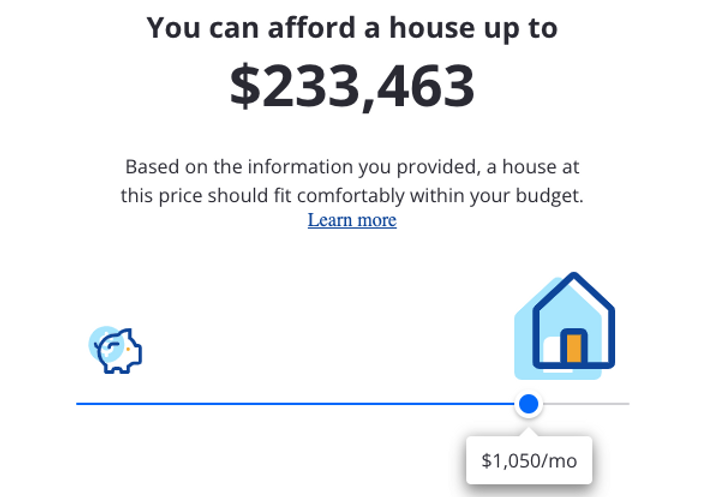

Let’s say you have no other debts, make $35,000, and have $52,000 for a down payment on a home. That means a lender could approve you for a home that costs more than $225,000, with a $1,050 minimum payment on a 30-year mortgage:

Source: Zillow.com Now, that may not sound like too much house right now, but let’s do the math. It’s important to realize that lenders will ask you how much you make before taxes. Why they’d calculate how much you can afford with money you don’t even see during the year, I don’t know. But anyway… making $35,000 a year as a single person living where I do (Florida), that means you’re taking home about $1,147 per paycheck, if you get paid every two weeks. That works out to about $29,822 a year that you’re taking home, or $2,485 every month. Your minimum payment ($1,050) is a whole 42% of what you take home every month, even with a very generous interest rate. Spending almost half of what you make on the home you live in, whether you rent or own, is spreading yourself too thin. What about utilities, such as water, power, and gas? What about periodic maintenance? What about homeowner’s insurance? After those additional housing costs, for sure you’d be spending more than half your take-home pay on just the roof over your head. So, how much house is too much? If you’re spending more than 25% of your take-home pay, it may be too much. And to be clear, it doesn’t mean it’s not affordable right now. It just means that you could be at risk of spreading yourself too thin. If an emergency pops up or if you have a costly expense, or anything like that, the mortgage you could once afford yesterday becomes a huge burden today. So, it’s best to try to spend around 25% of what you take home each month (or less) on housing. It gives you wiggle room for the things you may not see ahead. And it gives you the ability to save for those rainy days. When I bought my first home, I didn’t consider how much my mortgage and other housing costs would be compared to how much I was making. And I would’ve felt a lot more at ease had I done that. So, before you decide to buy a home, think about these things first. It’ll save you a lot of stress and heartache. And next time, I’ll go over a few more things to keep in mind before stepping into buying a home. They’re things I wish I’d thought about before, too.

With gratitude,

Melody C. Kerr, MS

Writer, Editor, Financial Coach