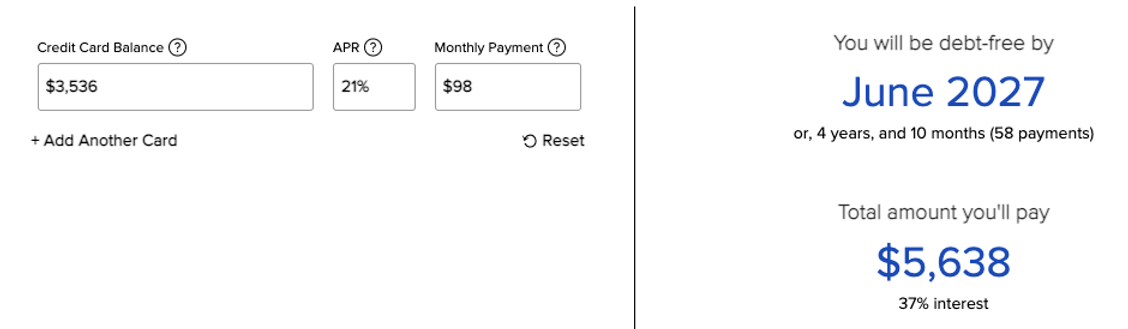

Like I mentioned in Making Cents last time, sometimes we end up spending up to 83% more using credit cards as opposed to using cash. Just as an example, that’s like spending $915 instead of $500. Literally, hundreds of dollars more. I know for sure I can’t afford to spend $415 more every month. If you’re seeing that you can’t, either, and you want to pay off those credit card balances, then keep reading. I’m about to explain something about credit cards that you’ll want to understand as you make paying them off your mission. Compound Interest First off, remember that using credit cards means that we’re spending someone else’s money… which has a cost. And it’s called interest. I mentioned the average credit card interest rate a couple years ago. Back then, it was around 16%… Well, now it’s actually 21.33%, according to personal finance website The Balance. Credit card companies refer to it as the APR, or annual percentage rate. They split annual interest into a daily rate. So, 21.33% ÷ 365 days = .0584%. According to financial research institution Shift Processing, the average credit card balance in Germany is $2,052. In Japan, it’s $2,900; in the UK, it’s $3,245; in Canada, it’s $4,154; and in the U.S., it’s $5,331. If I just take the average of these five countries, that’s about $3,536 in credit card debt. In August, for example, if you started with a $3,536 credit card balance this month and had a 21% APR, your minimum payment would most likely be around $100. So, it’d take you practically five years to pay it off… And that’s only if you don’t add more to your balance. Meaning, you’re not using the credit card for any other purchases…

Source: Credit.com

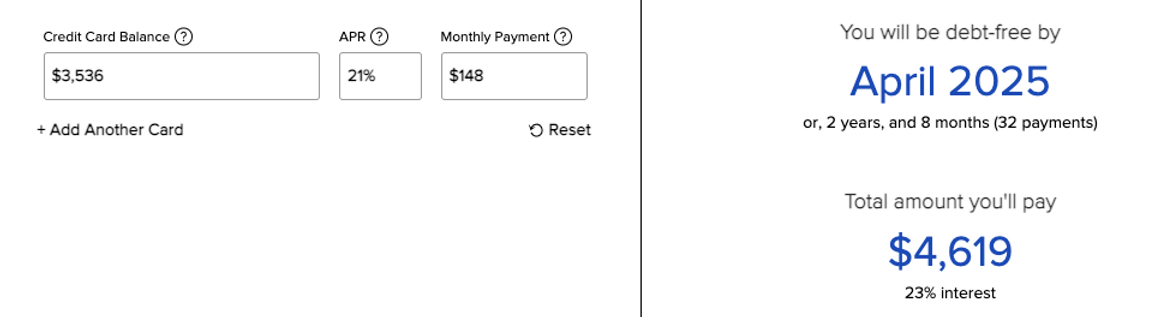

If you took $3,536 and divided it by the $98 minimum payment shown in the example above, you’d see that it should take 36 months (three years) to pay off the balance. But that’s the consequence of compounding interest: more time and money. With the 21% interest on this balance, it’ll take almost two years and $2,000 more. Go Beyond How could you pay off something like this more quickly? Pay more than the minimum. Credit card companies and lenders, in general, only require you to pay “the minimum payment,” because they know they’ll make more money off of you when they give you a lower, more attractive amount to begin with. But don’t fall for it. If you’re going to use credit cards, do not spend what you do not have. That means, if you have $100 to spare, then you should only spend $100 or less using your credit card. That also means you should pay off the balance by the due date each time. This way, interest doesn’t apply. Think of interest as a penalty. If you don’t pay off the balance by the due date, your penalty is paying back more than what you borrowed. If you’re not in a position to pay off the balance every month, pay as much above the minimum as you can. Using the same example I did before, if you pay $50 more than you’re required, you can actually pay off the balance two years faster…

Source: Credit.com

The bottom line is, do more than you’re required, and you’ll find that it pays off in the long run. Also, do your best not to add more to your credit card balance, and try to get into the habit of using either cash or debit. If you feel like you’ve dug yourself so deep into a hole using credit cards that you can’t fathom how to stop using them, please don’t be discouraged. Take a deep breath, and then think about areas where you may be able to cut back and/or make more money. And don’t expect yourself to make a drastic change overnight. Old habits die hard. Give yourself some slack and work on improving on or getting rid of one thing at a time. It’s like unpacking after a vacation. Do you pick up the luggage, turn it upside down, and expect everything to go back where it belongs? No. You’d end up with a pile of clothes/stuff on the floor, wouldn’t you? Most likely, you first sort out everything. Second, you wash what needs to be washed. Then, they’re dried and folded. And finally, you hang them up, or put them away. Everything that is done correctly, is done piece by piece, little by little. It’s nothing different when it comes to money. Be patient, be diligent, be open to listening and following instruction, and be positive. And remember, good things come to those who wait.

With gratitude,

Melody C. Stampley, MS

Writer, Editor, Financial Coach