By Melody C. Kerr, Founder, Centsible Finance

For the past few letters, I’ve been talking about debt–or what I like to call “the plague”–and the steps we can take to get out of it.

As a quick refresher, I mentioned it all starts with a plan. That involves writing down all your debts from smallest to largest, writing down how much you spend on everything else every month, writing down how much you earn, and then doing the math.

If by the end of it you found that you had some leftovers, you’d be on your way to starting your debt snowball; and if you found that you are break-even or even spending more than what you earn, you’d be working on ways you could cut back so you can start the debt snowball.

But I want to take the time now to talk about how important it is to save first.

Saving Comes First

It’s not just our paycheck that we should consider to be our earnings.

When you’re saving, you’re actually earning, too. Think of the saying: A penny saved is a penny earned.

If we go back to debt for a moment, debt can be a huge burden in our lives in more ways than just financially. I’ve mentioned this before. It affects us emotionally, mentally, and even spiritually.

But the other thing about debt is, it steals from us…

When we have debt, we’re paying back what we’ve borrowed… and then some. In other words… we’re paying interest.

Credit cards, for example, have an average interest rate of around 16%, according to Bankrate.

So let’s say I use a credit card to buy a 50” TV and some new furniture, and the total for it all comes out to $1,000.

The average minimum monthly payment on a credit card is 3% of your balance or $25. Whatever’s greater. Three percent of $1,000 is $30, so let’s just go with that as my minimum payment.

With a $30 minimum payment, that means it should take less than three years to pay off the $1,000 balance, right? Well, that’s where the 16% interest comes in… (Rates can be as high as nearly 30%.)

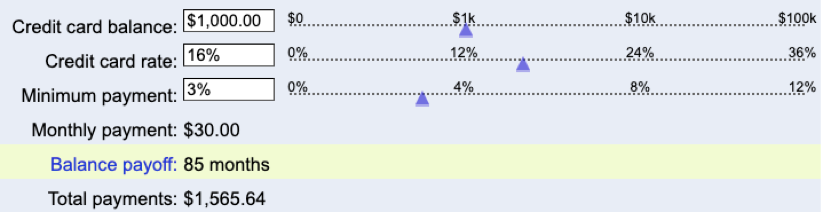

At a 16% interest rate, it will take seven years to pay that balance off–more than twice the amount of time. Take a look…

Source: Bankrate.com

And notice the total payment at the end of those seven years? Not only will it have taken seven years to pay off the balance, but it also will have given my credit card company an extra $565 of my hard-earned money… that I never even borrowed in the first place.

Now, here’s the thing… If you decided to save up $1,000 at a similar pace, it would only take you half the time.

If you saved $30 every month, you’d have $1,000 saved in less than three years ($1,000 ÷ $30/mo. = 33.3 months). Even if you saved $25 every month… that would take you less than three-and-a-half years ($1,000 ÷ $25/mo. = 40 months)–less than half the time it would take me to pay the $1,000 I borrowed from my credit card company.

Saving earns for you; debt steals from you (your money and your time).

Since debt steals, you may think it’s better to work on your debt first. But if something unexpected happens and you have no savings, you’ll end up adding to your debt. It would be like taking one step forward and two steps back.

So, before you start chipping away at your debt, if you don’t have savings for a rainy day, work on that first.

If you have $200 to spare, it will take you less than half a year to put $1,000 aside ($1,000 ÷ $200 = 5 months).

Even if you save just $25 (or less than that) every month, a penny saved is a penny earned. Just stick with it.

Go back and read “How to Cut Back.” You can use it as inspiration for getting creative in your thinking and finding areas in your life where you can spend just a little bit less.

I know all this may sound like a long road… Like you can’t see the finish line. Like it’s going to take a long time to get there… Like this is going to require you to make sacrifices.

And it may be a long road. But it doesn’t make it any less worth it. Just remember: Nothing worth having is easy.

Life is a journey. There are going to be winding roads. And there will be things around the bend you didn’t see coming that will throw you off. But if you stay focused, you’ll get to the end. And you may even get motivated to get there faster.

So, think about saving first. Even if it takes some time to get there, it will be worth it.