Budget…

When you hear that word, does it make you cringe? If your answer is no, great! Maybe you see the value in a budget. But if your answer is yes, it’s okay. The word “budget” has kind of a scary, intimidating feel to it. And for some of us, the word can even have an opposite feel: inferior, cheap, pathetic….

But a budget doesn’t have to be any of those things. In fact, even wealthy people live life on a budget.

And if we want to achieve financial freedom, we can learn a few things from some of the wealthiest people in the world—and take a few pages from their book…

Suitable for Any Lifestyle The first thing we have to understand is, there’s nothing wrong with a budget. Get this…

Warren Buffett, one of the most esteemed investors in the world, still lives in the same home he purchased back in 1958! In today’s money, it cost him about $282,000. His net worth is upwards of $80 billion. So, clearly, he can afford to live in a much more lavish, expensive home if he wanted to.

And Facebook CEO, Mark Zuckerberg, still shops at Costco… He has a net worth over $100 billion. He can afford to ask someone else to do the grocery shopping for him, or better yet, have gourmet meals prepared for him every day, for the rest of his life.

But, as you can see with these two billionaires, just because you can, it doesn’t mean you should.

One thing I notice with Buffett and Zuckerberg is their shameless habits.

Here we have one man who can live in a beachfront mansion for the rest of his life, yet, he chooses to live in the same home in Omaha, Nebraska, that he purchased 62 years ago.

And then, we have another man who can eat the best meals prepared by famous chefs every day, yet, he chooses to look for wholesale prices on groceries.

I’m sure a lot of us would be quick to criticize them and say, “Wow, look how cheap they are. How pathetic.”

But instead of them worrying about other people’s opinions about how they choose to live their lives and spend money, in many ways, they’re living their lives the same way they did before they became billionaires.

Whoever said, “If you have the money, spend it,” probably isn’t nearly as wealthy as Buffett or Zuckerberg.

Living modestly, understanding our wants vs. our needs, and saving are all lifestyle changes we should make.

We don’t need the flashy car. We don’t need the newest cellphone. We don’t need brand-name clothes and shoes. We don’t need a big house. We don’t… Not if we can’t afford any of it.

Remember, our goal is financial freedom. And if we worry about how “rich” we look to others and spend our lives buying this and buying that to “look the part,” we’re only doing ourselves a disservice. Not anybody else.

We can worry about those things later… when we can afford to buy them… with cash.

And part of affordability is not spending more than we earn. In other words, part of affordability is living on a budget.

Tell the Money Where to Go So, what exactly is a budget?Well, it’s your guide to how you spend the money you earn. I’ve talked about this before. A budget is where you start. A budget is your plan. Your road map. Your lifestyle.

So, with a budget you have a “map” that shows all your earnings and expenses on a monthly basis. This would include categories like, rent/mortgage, utilities, food, clothes, transportation, medical insurance, leisure, giving, and saving.

Keep track of how much you spend vs. how much you earn and do the math. If you’re a pencil-to-paper person, write it all down. If you’re an e-file person, there are several online budgeting tools you can use, like Mint, Pocketsmith, and EveryDollar.

But after you do the math, if you find some alarming things (for example, spending more than you earn), don’t get discouraged. Take a deep breath and remember you’re not alone. Eighty percent of us spend more than we earn. In other words, we live in debt.

Don’t think about how you got into this situation. Think about what you can do now to get out of it, starting this very moment.

What can you do right now? You can tell your money what to do, moving forward. So, instead of letting the money you earn dictate to you, you dictate to the money where it should be spent.

If you notice your insurance is expensive, call up your insurance company and ask about discounts. Or shop around. Maybe you can get a better price for the same coverage elsewhere.

If you notice you’re spending a lot more on dining out than you realized, get an envelope, put only a specific amount of cash in it, and write “Dining Out” on the envelope.

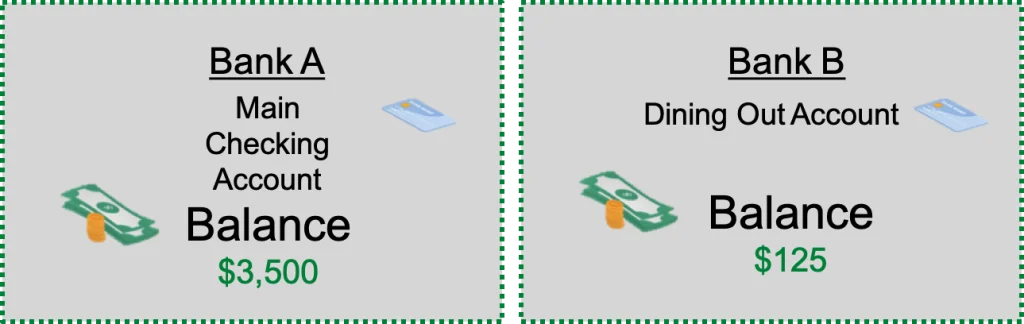

Use it to pay for your meal whenever you go to a restaurant. When the cash in the envelope runs out, that’s it for the month. If you don’t like cash, consider creating a separate account for dining and deposit a limited amount in the account. Use that for your meals. Again, when there’s no more, that’s it for dining out until the next month.

But be sure to use two different banks. If you just have two separate accounts at the same bank, you’ll be tempted to just transfer money between the two, since the transfer will happen instantly. Separate banks usually have a wait time of around one to three days. It’ll be easier to stay on track with your budget if you have to wait for the money to transfer to your dining account. If you notice you’re buying more clothes than you realized, go to places where you won’t be around stores that’ll entice you to walk inside. And do the same thing I just mentioned with the cash envelope or separate account. Here’s another idea: Some people even stick their credit cards in a bag of water and put it in the freezer. Imagine wanting to go to the store to do some shopping… Only, you have to wait for the credit card to thaw out. Whichever method you try, just remember you’re practicing discipline, regardless. You could jump through all these hoops, but if you realize you still have all your credit cards set up through Apple, Samsung, or Google Pay, or whatever else they have out there, you may spend it. So, don’t be afraid to cut those out, too.

If you know that you’re a pretty thrifty person but you just need more money, maybe it’s time to ask for a raise or get a second job.

There are several other options.

The main thing here is to figure out where to direct the money you make, so that it’s working for you and not against you.

With a budget, we want to be able to know ahead of time what we spent, when we spent it, and why. What we don’t want to see is our hard-earned money fly out the door, wondering where it all went and how it did that so fast.

So, don’t let the word “budget” stop you from the ultimate goal: Financial freedom. If it makes you feel better, call it a “plan.” Call it something else, if you want. But whatever you do, make the decision to start telling the money you work so hard for what to do, not the other way around.

Ignore the people who tell you, “It’s time you get a new car. Yours is so old.”

And ignore the people who tell you, “You’re so cheap.” Because, first of all, there’s a big difference between being cheap and being frugal.

For one, according to Business Insider, a study of 600 millionaires shows that frugality is one of the key characteristics of wealth. And two, it doesn’t matter if you can afford to buy something more expensive.

Every dollar, every quarter, every dime, every nickel, every penny counts. That’s part of the reason why someone becomes wealthy in the first place: Realizing that everything adds up over time.

But if being conscious of where every cent of your hard-earned money goes is considered “cheap” to the people around you… then, so be it. It’s better to be “cheap” in that regard than to be cheap when it comes to giving (or not giving) to others…

And if it’s necessary, ignore all the outside noise that tells you to get this… get that… swipe now. Ignore the commercials that tell you your phone is out of date. None of that really matters. Keeping up with appearances keeps us in debt. So, remember: Live for you, not for the Joneses. Because the Joneses don’t pay your bills.

With gratitude,

Melody C. Kerr, MS

Certified Financial Coach