Here’s a number for you: $1,300. That’s how much average shoppers in the U.S. add to their debt during the holidays. That’s according to MagnifyMoney’s post-holiday survey conducted last year. And I mentioned before that most of the people surveyed said they’d need at least three months to pay that off. But for you and me, it could be more than $1,300, and it could take much longer than three months to pay off. So, instead of having joy over the holidays for what the season really means, we have stress. We live in a world that tells us happiness can be bought. That’s part of the reason why we sometimes believe we have to go overboard with our spending when buying gifts. But we don’t have to. Although the best gifts in life are free, when we do go shopping for those gifts, we don’t have to go broke in the process. So, if you’re still doing some holiday shopping, here are some ideas…

Money-Saving Ideas for the Season I know shopping online is “in” more than ever these days out of convenience, but there are plenty of websites you can visit to get the items you’re looking for at the best prices. Just to name a few, Slickdeals, ShopAtHome, Hip2Save, Honey, of course, Groupon, and RetailMeNot. They’re all good places to start when you’re shopping. And some of them let you set up alerts or take surveys to earn cash back, so you can put a little cash back in your pocket and never miss out on a good deal. Here’s another idea: Don’t be afraid to get creative. Sometimes, the best gifts are the ones we make ourselves. That could be clothing or linens, if you can sew. A shirt, a pair of pants, a blanket, or even curtains are all great ideas. That could be a work of art, if you’re artistically inclined. I remember getting a birthday card made out of cardboard. It was black and white, and part of it was cut out into a butterfly. It was beautiful and it’s one of the best cards I’ve ever received. Speaking of cards, don’t underestimate the greeting card. Like I mentioned before, I’ve been keeping the greeting cards I’ve received for as long as I can remember (for at least the past 18 years). And every so often, I flip through the scrapbook I put them in. Cards are a nice reminder of the people who were thinking of you during birthdays, milestones, and holidays. A lot of people spend the holidays alone. So, just a simple card lets them know someone’s thinking about them. That brings me to another idea: Quality time. Many people actually find the holiday season to be quite depressing, because they spend it by themselves. Why not surprise them with just a video call, if you can’t be near them? It might seem small, but it could mean the world… especially if you’re the only one to do it. And, to me, food is never a bad idea. Whether you prepare a meal for a loved one or help prepare one by volunteering at a homeless shelter, comfort food could be the best treat for someone during this time. Also, try doing some research online. I typed into Google, “best gifts when you’re broke,” and I found 41 gift ideas.

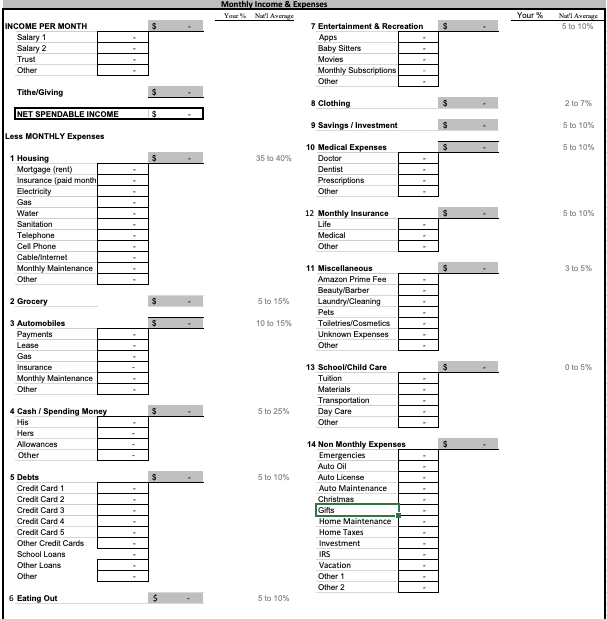

Plan Ahead My last idea is something that will help you for next year’s holiday season but works best when you start early. Plan your holiday spending into your monthly expenses. Look at the budget sheet below:

You can see that there’s a “Gifts” category toward the bottom. But it’s pretty broad, meaning, it could be a birthday gift or a gift for a special occasion, too. So, let’s say you don’t really spend money on gifts every single month. You should still make room and put aside money every month, so you’ll have the cash ready to spend when the time comes. Just as an example, if you spent $300 on miscellaneous gifts for people this year, but you spend $1,300 on gifts for the holidays (remember, $1,300 is the average we spend over the holidays), that’s at least $1,600 you should work on saving up in 2021. But the best thing to do is to save up little by little. So, you’ll set aside some money every month. Since there are 12 months in a year, you’d be saving at least $133/month ($1,600 ÷ 12 months = $133.33). But to have the money before you start shopping in December, you’d want to save $145/month, so that you’ll have $1,600 by the end of November ($1,600 ÷ 11 months = $145.45). And, of course, if you usually begin your shopping in the beginning of November, you’d be putting away a little more than that. This isn’t foolproof. Because if the $300 you spend on other gifts throughout the year just so happens to fall in one of the earlier months of the year, like March, that means you’d want to save $150 in January and $150 in February. But the point I’m trying to make is, even if you don’t buy gifts every month, make sure you put money aside monthly, so you’ll be ready with cash when it’s time to buy someone a gift. I hope this helped, if you’re in a bind right now. But above all, just remember, you can make the holidays special without all the gifts. What’s really important isn’t anything you can find at the store. It’s what comes from the heart.

With gratitude,

Melody C. Kerr, MS

Certified Financial Coach