I want to start off today by giving you two numbers: .05% and 5%. That would look like 5¢ and $5, respectively, on $100. Where’d those numbers come from? Those are the returns for an average savings account and the average investor, respectively.

According to The Balance, the average investor makes a 5% return on his/her investments. And, yes, the average savings account only returns .05% in a year. That’s according to the FDIC.

A couple months ago, though, the average savings account was posting a .09% return. However dismal .09% is, as you can see, it’s gotten worse.

With the country—and countries all over the world—still trying to recover from the economic whirlwind the coronavirus pandemic caused, the Federal Reserve has gradually dropped rates.

Honestly, there’s a lot that goes into this, but to put it simply, when the Federal Reserve drops national interest rates, the interest you earn from putting your money in a savings account drops, too.

So, while I’m a big proponent of saving, the point I’m trying to make today is that you should also focus on investing.

Saving vs. Investing Investing can be extremely complicated… but only if you let it be. First off, if you want to know the difference between saving and investing, here it is in a nutshell: Saving is putting cash away for a need in the future. Investing is putting your money into what you believe may grow more valuable over time.

You can turn an investment into cash, but you’d have to sell the investment first. So, basically, your savings is readily available cash, whereas your investments are assets you expect to grow before you liquidate them into cash.

I want us to understand the importance of both. Because they both relate to your future… I’ve talked about the importance of saving before (and will continue to every now and then), so you can read about that here and here. So, let’s talk about the importance of investing…

There’s a big difference between 5¢ and $5. And when you start to work with real money—like $1,000, $5,000, $10,000, or even more—the difference becomes magnified.

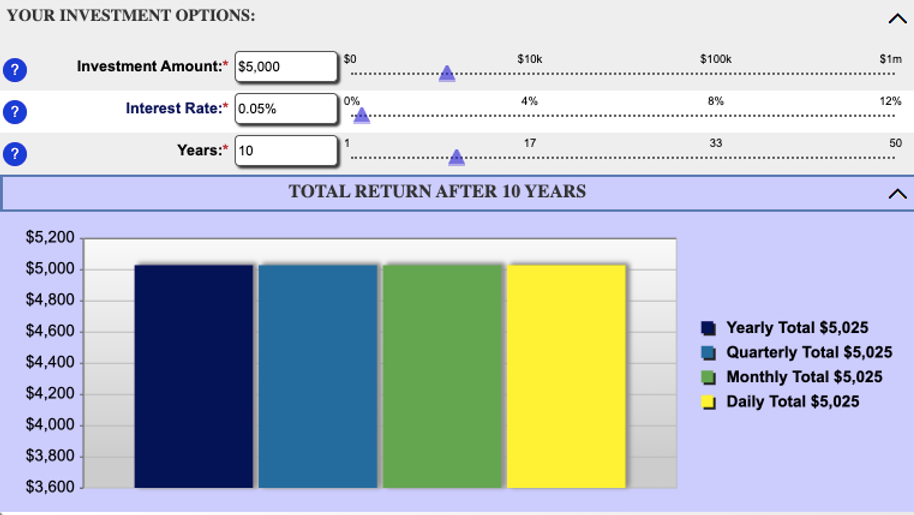

Take $5,000 for example. If I decided to put $5,000 in a regular savings account and let it sit there for 10 years, I’d end up with $5,025 in the end. Only $25 earned. Not much at all, but at least it’s more than I started with, right?

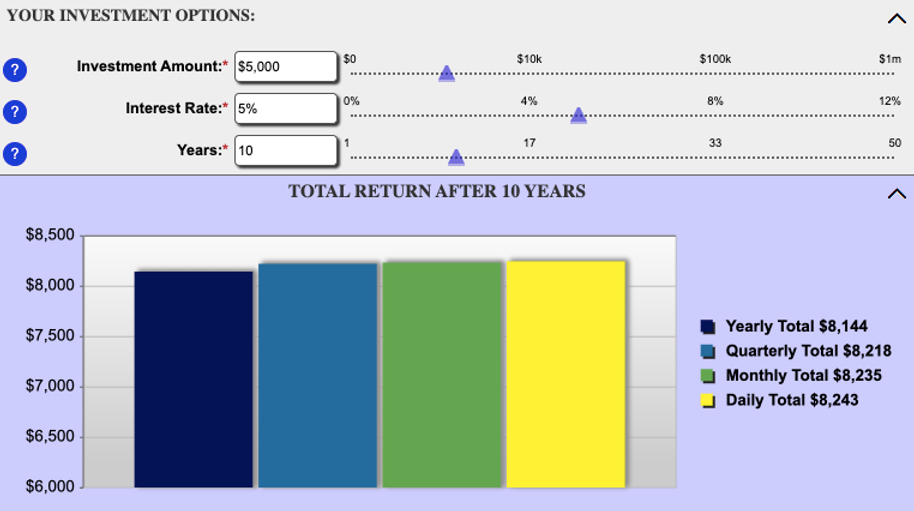

Now, if you took $5,000 and let it sit in an investment account for 10 years, based on how the average investor fares, you’d have $3,000 more than me.

Take a look…

Source: Compass1.org.

The first chart shows my $5,000 put away and how much it would return. And the second chart shows the $5,000 you invested. The daily, monthly, quarterly, and yearly totals vary a bit, but even if we went by the lowest return, you’d end up with $8,144… versus my $5,025.

So, although I’m not telling you to stop saving (it’s always a good idea to save first), I hope you see how investing can work more in your favor over time.

Start With Retirement The best place to start investing (or to invest more) is in a retirement savings account. It doesn’t matter how far away retirement seems… It’ll be here before you know it… whether you plan on retiring at 65 or never retiring at all. (I’ll get into that another time.) And I believe a retirement savings account is the secret to a good retirement—and the key to financial freedom.

According to personal finance expert and bestselling author Chris Hogan, 80% of millionaires built their wealth through a retirement savings account.

The most popular retirement savings accounts are the 401(k) and the Individual Retirement Arrangement (IRA)—most of us call it an Individual Retirement Account. The 401(k) is a savings plan that your employer may offer you. And many employers offer a match. What that means is, they’ll contribute to your account, as well, but only if you do.

For example, if my employer offers a 50% match on the first 4%, based on an annual salary of $35,000, within a year’s time, my employer will have contributed an additional $700 to my retirement, if I contributed 4%. ($35,000 x .04 = $1,400; $1,400 x .5 = $700.)

And if your employer offers a 100% match on the first 4%, that means, based on the same annual salary, within a year’s time, you’d have an additional $1,400 in your retirement account. (That’s only counting contributions.) An IRA, on the other hand, is a retirement savings account you’d set up for yourself. It wouldn’t get the perks of an employer match, but it’s still an amazing way for you to invest.

(Did you know you can invest in both a 401(k) and an IRA at the same time? If you want to find out how, you can shoot me an email right here.)

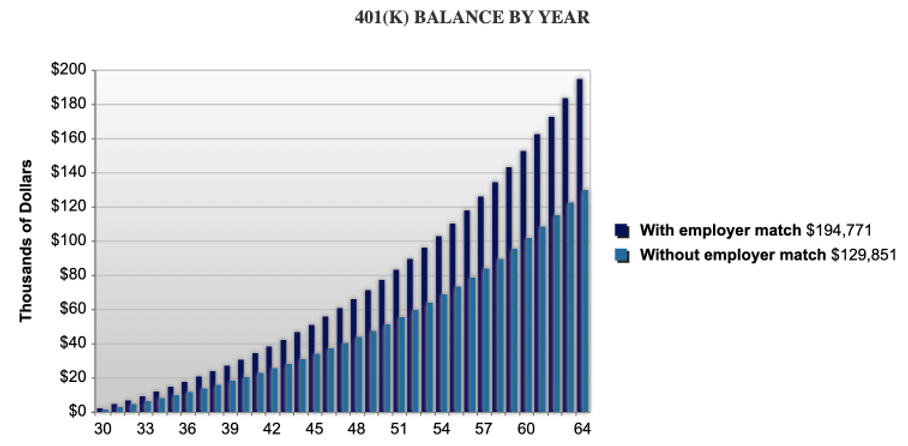

Here’s another illustration for you. Below is a chart that shows how your 401(k) retirement account could grow over the years:

Source: Compass1.org

As you can see, at 30 years old, if you invest 4% of a $35,000 salary for the next 30-odd years, you’d have $130,000 for retirement… but nearly $200,000 with an employer that matches you 50%.

The numbers grow exponentially if you decide to invest more, too. For example, if you invest 15% of your income (the typical recommendation), you’d actually have over $350,000 more. And we haven’t even gotten to the potential of your returns…

This is the power of investing. So, while I may have used 30 years old as the example, whether you’re younger or older, investing now—starting today—can make a huge difference in your life.

Investing Isn’t Too Risky And let me say this: A lot of us don’t invest because we don’t understand investing and it scares us.

It wasn’t until a couple years ago that I realized I was putting too much of my trust in saving and too little of it in investing.

I’ve never been a risk taker. And to me, because I didn’t understand it, I believed investing was a 100% gamble. But through reading up on this concept, I learned: not to be too afraid, because practically everything in life is a risk; never to invest with money I cannot afford to lose; and investing is not 100% risk, especially if research is in it.

As I mentioned above, investing only has to be complicated if you allow it to be that way. Honestly, if there are things you think you just will never understand about investing, just look at the two numbers I mentioned above (.05% and 5%). If you want your money to go further and potentially work for you, you have to invest.

As long as you understand that, you’re ready to start!

It’s a new year! Don’t let fear of the unknown stop you from investing in future you. And here’s the thing… You can let the experts worry about the ins and outs. You can use a service that connects you with financial advisors in your area to help you. SmartVestor Pro is one.

Many of us haven’t the slightest clue about the cars we drive. We just take it to the mechanics and let them handle the maintenance. Shouldn’t it be the same with the other things in our lives?

I understand your car maintenance is not the same as placing your hard-earned money in investments, but the takeaway here is that we must all recognize the power of investing. We may not understand it completely, but if we take the first step in the right direction, the rest gets easier.

Today is an opportunity to do what you can now for future you. So take those first steps to invest in yourself. Starting today… Starting now…

With gratitude,

Melody C. Kerr, MS

Certified Financial Coach