Last time, we talked about how 80% of millionaires built their wealth through investing in their future—their retirement savings account. So, if you have enough saved (three to six months of living expenses) and you’re out of debt, now is the perfect time to start saving for future you. I mentioned this in November. No matter your age, it’s never too early or too late to start. But if you feel discouraged because you believe you’ve missed out on not starting soon enough, I also mentioned before that you’re not alone. A lot of workers in the U.S. haven’t started, either. Almost half of Americans over the age of 55 don’t have a retirement savings account, according to the U.S. Government Accountability Office. So, without hesitation, most of us will say there are things we would do differently, if we could go back in time. But if you’re using any of your energy thinking about what you should’ve, would’ve, or could’ve done differently… don’t. Let’s use that energy to start a new path. One of the main reasons why we prolong doing things we know we should is because they’re intimidating. But if you’re ready to start saving for your retirement, I’m going to show you just how simple it is today.

Setting Up Through Your Employer Now, if you decide you want to set up a 401(k) or 403(b), or any other retirement plan offered by your employer, the best part is you really don’t have to worry too much about the setup process. That’s because, once you tell your HR department that you’d like to contribute to the plan they offer, they’ll do the legwork. The main thing you need to concern yourself with is deciding how much to contribute each pay period and which funds to invest your money into. So, that’s what you can expect when contributing to a 401(k) or other employer-sponsored retirement savings account. The rule of thumb is to contribute 15% of your gross pay (what you make before taxes) to your retirement. So, if you make $35,000/year, that’s $5,250 toward retirement every year, or around $200-plus every time you get paid. As far as which funds to invest in, don’t be alarmed. Typically, you’ll have the option to choose what your brokerage recommends. And, of course, if you’d rather make your own selections but you’re just not confident, this is what financial advisors are for. You can use sites, such as SmartVestor Pro, to find an advisor in your area. Of course, I’d be happy to talk with you about how you can get started, but I’m a financial coach. And there’s a difference between a financial advisor and a financial coach. Basically, an advisor can recommend different vehicles you can (and should) invest in and holds a securities license to do so. But a coach is someone who will guide and motivate you through your decisions regarding your personal finances and help you prioritize your goals (getting out of debt, saving, budgeting, etc.) based on your financial situation and needs. So, if you’re ready to start investing in your future and you want to be hands on with your investments, an advisor would be the best person to recommend which investment vehicles would be best for you. But if your employer doesn’t provide an account like that or if you can’t contribute to one for any other reason, most likely, you can still save for your retirement through an IRA (Individual Retirement Arrangement, more commonly known as “Individual Retirement Account”). And there are different types of IRAs:

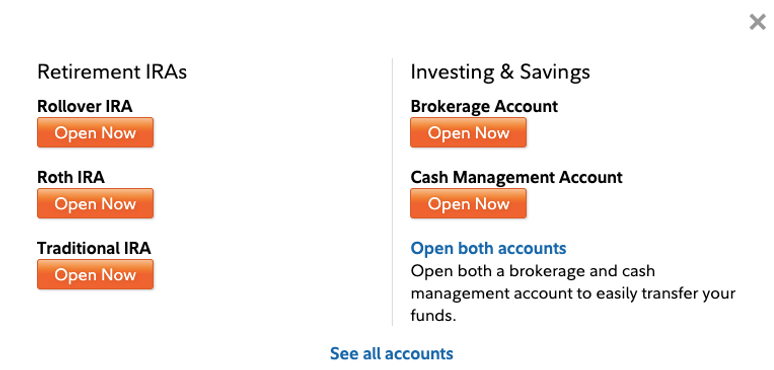

- A Rollover is one you’re moving from one broker to another IRA or other retirement account, such as a 401(k);

- a Traditional is one you can contribute to before taxes, meaning it won’t count toward your taxable income, and you won’t pay taxes until you withdraw;

- and a Roth is one you can contribute to after taxes, and you won’t pay taxes when it’s time to withdraw.

Below, I’ll take you step by step on how to get started with your own IRA.

Setting Up Your Own

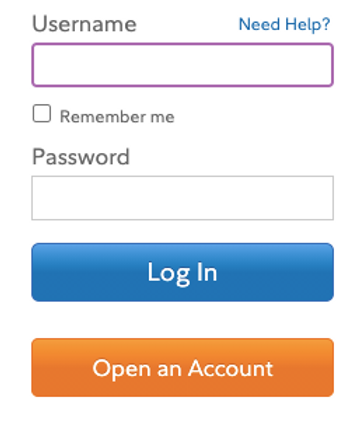

1. Open an account on your chosen brokerage’s site. (In this example, I used Fidelity, so what you see may differ; but the steps will be very similar.)

2. Choose the type of IRA you’d like to open.

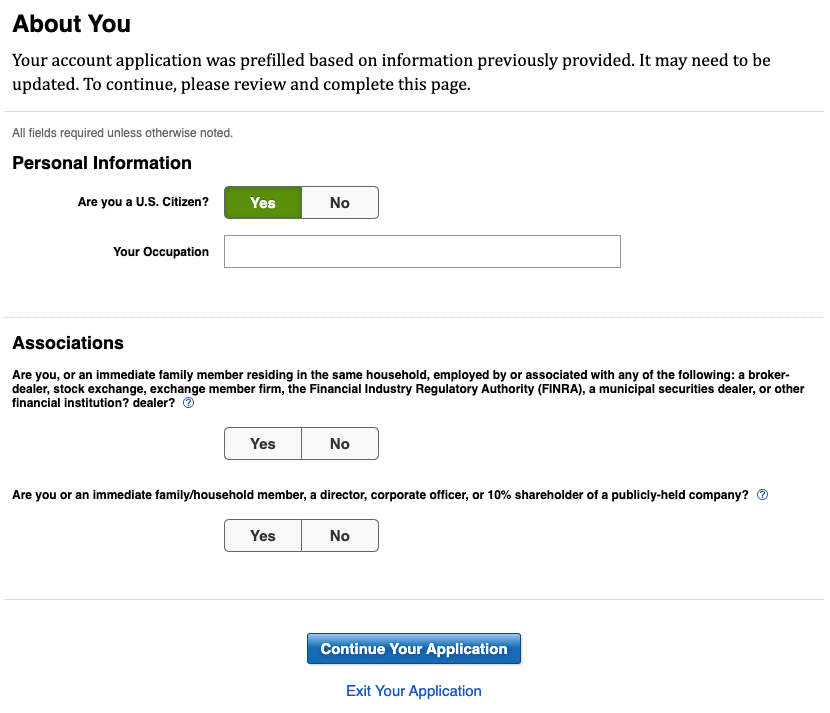

3. Fill out the application.

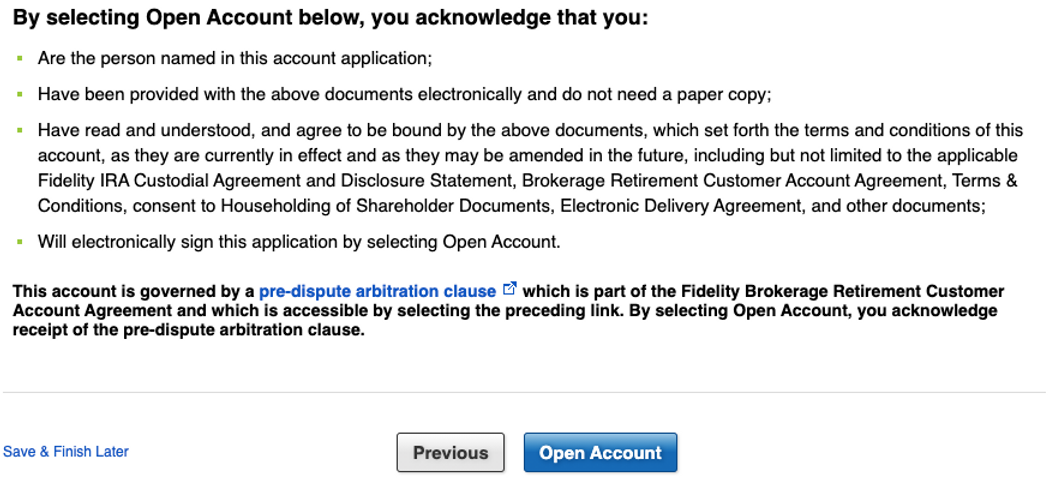

4. Review your application to make sure it’s accurate.

5. Open, read, and save the documents, if you agree to the Terms. And open your account.

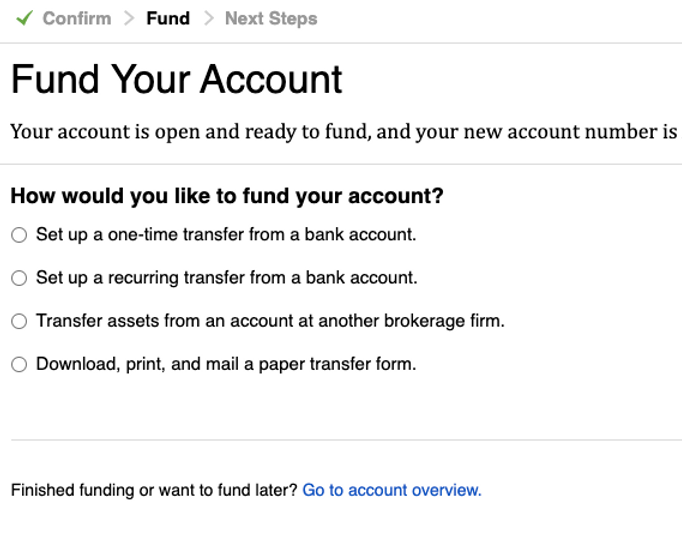

6. Fund your account.

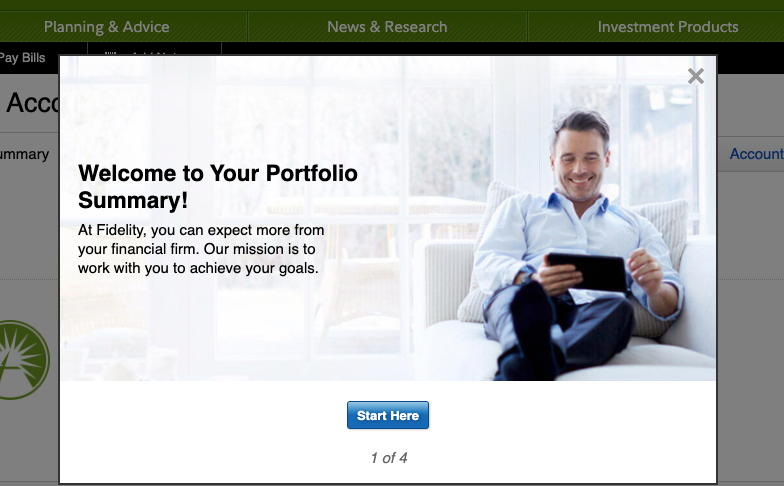

7. Tour your new account to get familiar with it.

8. Start investing.

As I mentioned above, you can speak with an advisor, if you need help. And many brokerages will recommend an investment strategy for you, too. And remember, you can always call your brokerage’s customer service for help with things like transferring funds or making transactions online.

Now, Keep Going If you followed those steps, congrats! Just remember to focus on contributing to your account on a regular basis. As I mentioned earlier, aim to contribute 15% of your annual income (before taxes). But if you can’t afford to, don’t let that stop you. Just contribute what you can. Every little bit counts. So, whether it’s $200 or $25, it’s better than nothing at all. We all have to start somewhere. Which brings me to the last thing I want to mention today… If you didn’t follow these steps and you’re still unsure about whether you should start saving for retirement now, sometimes, all we need is another perspective to help us make a decision. One thing I know for sure is saving with future you in mind is not a decision you will regret.

With gratitude,

Melody C. Kerr, MS

Certified Financial Coach

P.S. Like I said, if you’re unsure about whether you’re ready to save for retirement yet, talk to someone. You can schedule a session with me right here.