Last time, I told you about two companies whose stock prices have been taking off over the past couple months. They were AMC Entertainment and GameStop. Most of us have probably heard more about GameStop. It went from trading around $4/share in August to about $350/share last month. And guess what… It’s now just worth around $40/share. Now, if you remember when I first mentioned what was happening with GameStop, the stock was already on its way down. At the time (only two weeks ago), GameStop had already dropped more than 50%. That’s why I just want to remind you of two things today…

Don’t Be a Follower The first thing is: Don’t follow the crowd. Many times, when we decide to invest our money into something (stocks, in this case), it’s because other people are doing it, too. But just because everybody else is doing it, that doesn’t mean the right thing would be to follow suit. If you’ve ever gotten lost on the road, you know exactly what I’m talking about. You know, you get lost but see the car in front of you and think: Let me follow this person. They look like they know where they’re going. Next thing you know, you end up even more lost because they took you farther away from the direction you wanted to go in, or you find out they were lost, too. It’s similar with investing. Most of the time, investors don’t make money by doing what everyone else is doing. They make money by doing the opposite. Don’t follow everybody else, especially if they’re not an expert. They could be just as lost as you.

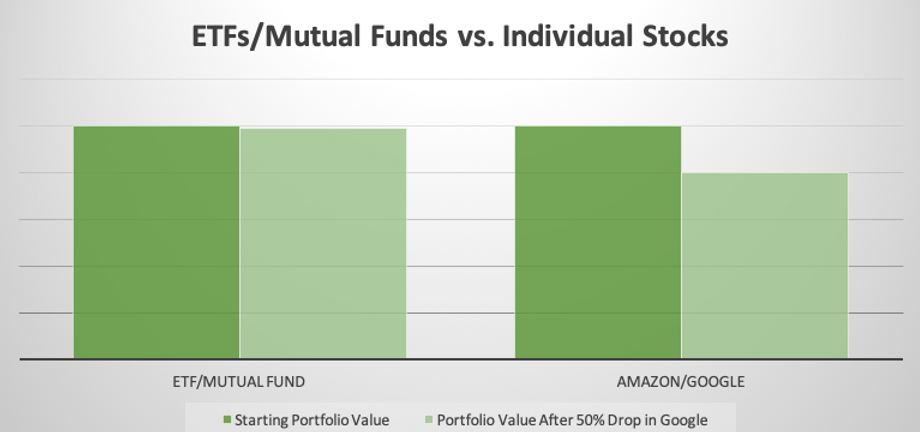

Start With Funds … When You’re Ready Now, the second thing is: Don’t put yourself at more risk unnecessarily by investing in stocks. Invest in exchange-traded funds (ETFs) or mutual funds… but only when you’re ready to invest. ETFs and mutual funds basically own a basket of stocks. Some less than others. Many of them have hundreds of stocks in the fund, but typically, the smallest ones have about 35 to 50. They’re all different, so, although plenty of these funds own shares of some of the biggest companies in the U.S., like Amazon, Alphabet (Google’s parent company), and Apple, not all of them will. But the point is, investing in these funds gives you the opportunity to own a little bit of several stocks, without all the risk. The last time I checked, one share of Amazon would cost you upwards of $3,000. And one share of Google would cost you about $2,000. That’s about $5,000 just to own one share of each. You can find plenty of ETFs/mutual funds that trade for around $100. (There are plenty that would cost you even less than that.) So, you could take that same $5,000 and buy 50 shares of that fund—and with less risk. Here’s what I mean… Let’s say I decide to take $5,000 to buy one share of Google and one share of Amazon. (Remember, Google trades around $2,000 per share; and Amazon trades around $3,000 per share.) This isn’t likely to happen overnight, but if Google’s share price plummets 50%, that means one share is now worth $1,000—half of what it was worth. That also means your portfolio is down 20% ($1,000 ÷ $5,000 = .2, or 20%). On the other hand, let’s say you decide to take $5,000 to buy 50 shares of a mutual fund that owns shares of 50 different stocks, including Google and Amazon. Since Google is only one of the 50 stocks in your ETF/mutual fund, it’s only a small part of your investment portfolio. So, if Google dropped by half, from $2,000 to $1,000, since there are 49 other stocks in the fund, your portfolio may be down, but you probably wouldn’t even notice. Below is a visual of how that would look:

As you can see, it looks like your fund’s value hardly budged… while the $1,000 loss in my portfolio is obvious. So, the money you invest goes a lot further in an ETF/mutual fund with a smaller amount of money. Just remember to invest after you get out of debt and have some savings to your name (at least three to six months’ worth of living expenses). (And if you already have money invested in your retirement, you don’t need to touch that. Just stop, focus on your debt, and then go back to investing once you’ve paid it off.) When you get out of debt (this doesn’t include your mortgage), that’s even more money you can invest. And the longer you take to pay off debt, the more it steals from you. On average, you can expect to make about a 7% to 8% return from your investments. Not bad. But credit cards and personal loans can charge twice (or even three times) as much. That means, while you return 8% from investing, you’re paying at least 16% in interest on a credit card. And it also means the interest is eating away at all your investment returns. Now, if you have a student loan, let’s say that charges 2% and you still return 8% from investing, you really only keep 6% (8% return – 2% interest = 6%). So, there’s power—and freedom—in getting rid of that debt. And you’ll have the freedom to invest in ETFs/mutual funds. And if you’re curious as to when—if ever—it might be a better time to invest in stocks, I’ll share that in another letter, when we talk about net worth.

With gratitude,

Melody C. Kerr, MS

Certified Financial Coach