Sometimes, we just need to see how something works to understand it better. So today, I’ll be doing more showing and telling than usual… If you remember, in the last issue, I talked more about debt. How to get out of it, what to do first, and why many of us never get the motivation to face it in the first place. And the main takeaway was to just start small. That means looking at the smallest debt you have, instead of looking at all of your debt combined, and then working on paying it off little by little. So, if a little visual will help you see your way through how to start tackling your debt, read on…

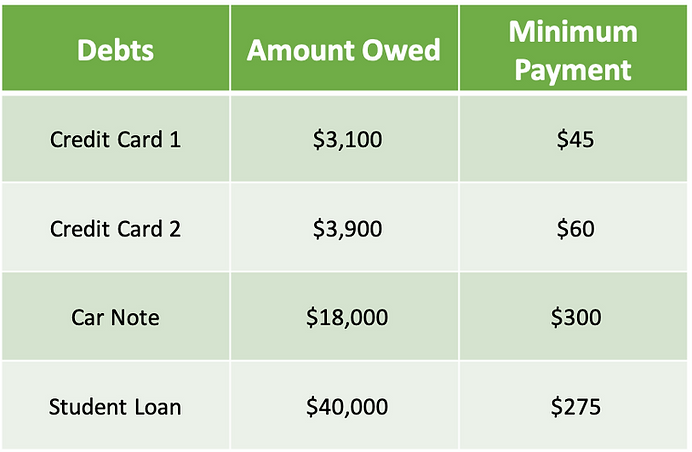

Start With What You Have First things first, you can only work with what you have. How much do you take home every month? Well, that’s what you start with. Let’s pretend you take home $3,000 every month. That would mean this is what you see in your bank account after taxes, your health insurance premium through your employer, retirement contributions and any other voluntary plans are deducted. Now, we need to do the math on how much you spend every month (on bills, food, and paying off debt) to create a strategy for paying off the smallest debt first. We’ll stick with the debt list from last time. Here it is below:

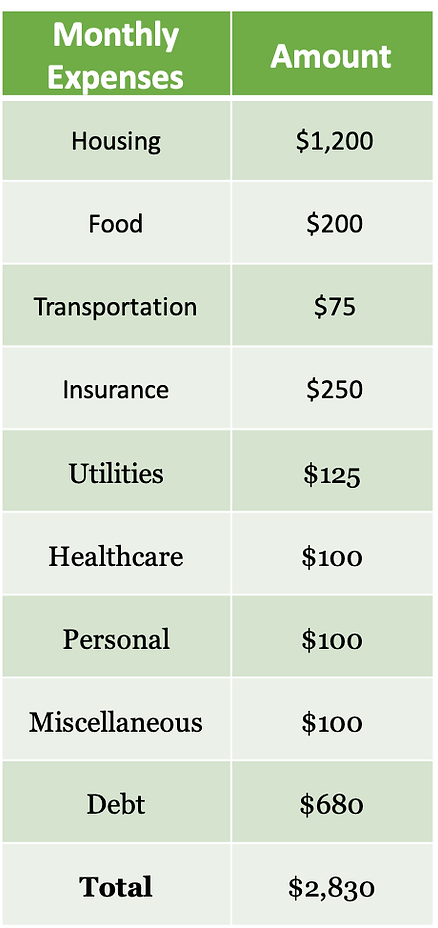

And we’ll use this breakdown of monthly expenses as our example:

If you add up the minimum payments for the four debts, you’ll get $680. Notice it’s included in the monthly expenses breakdown above. Altogether, we have $170 left over at the end of every month. ($3,000 monthly income minus $2,830 spent.) So, $170 is what you have—and what you’ll start with.

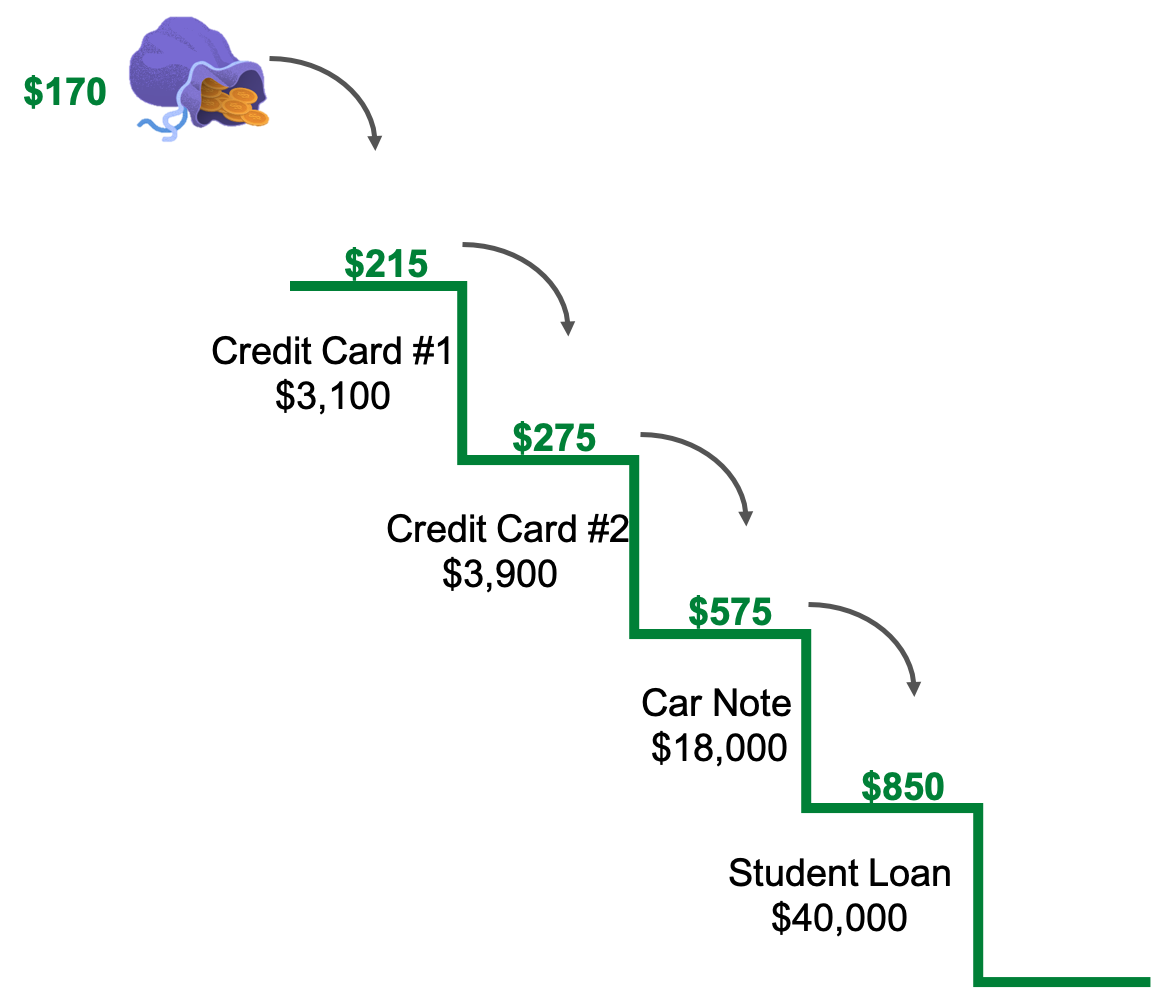

Start With #1 on the Debt List Now that you know you have $170 left over every month, if you already have at least $1,000 saved in case of an emergency, this is the time you’ll start throwing extra money toward your smallest debt. It’ll look like this…

The balance for Credit Card #1 is $3,100. And as you can see in the debt list above, the minimum payment is $45. So, if you add $170 to the $45 minimum payment, you will now start paying $215 every month toward this debt. Remember, though, while you’re doing this, you’ll still be making the minimum payment on the other debts. Looking back at our debt list, that means, while you’re throwing $215 at Credit Card #1, you’re still going to make the $60 minimum payment for Credit Card #2, the $300 minimum payment for the car note, and the $275 minimum payment for the student loan. Now, once Credit Card #1 is paid off, you can now cross it off your list (and pat yourself on the back) then add the $215 you were paying toward it every month to the $60 you were paying on Credit Card #2. So now, you’re working on your second smallest debt by throwing $275 toward your balance every month ($60 minimum payment + $215). Once you’re done paying that off, you’d add the $275 to the $300 minimum payment you were making on your car. That’s now $575 you’re throwing at your car note. By now, you get the picture. Once your car is paid off (and you celebrate), you’ll add the $575 payment you were making on the car to the $275 minimum payment you were paying on your student loan. That’s now $850 you’re throwing toward your student loan until the balance reaches $0. And when that moment comes, guess what. Happiness. Relief. Freedom. You can then take that $850 and put it in your emergency account every month, until you have three to six months’ worth of living expenses saved up.

Stay the Course I know this is exciting. Just thinking about the day you get out of debt can make you anxious or restless. It might feel like, even when you’re following this method to the T, you’re getting nowhere. But just remember, you probably didn’t get into debt overnight. So, you can’t expect to get out of it overnight, either. Just stay the course. And if you’re wondering if this method I’ve shown you today really works, the answer is yes… whether your biggest debt is $40,000 or $400,000—or more. It’s called the debt snowball. And it’s a great way to build yourself up and feel constant encouragement. If you’ve heard about other methods, such as the debt avalanche, where you start with the debt with the most interest, it’s not as motivating. Think about it this way: If your highest interest-bearing debt was the student loan above, you may feel like you’d be working on paying that off forever. And rightfully so. It’s $40,000. It may take you slightly less time to pay off your debt in the order of the interest rate from highest to lowest, but studies show the time you save is nothing worth writing home about. The difference is minimal. And it’ll feel much easier and gratifying first paying off a $3,100 debt than a $40,000 debt. Like I mentioned last time, the reason why so many of us never get started on our debt is because all we see is the mountain. So, if you’re someone who needs to feel motivated, just start with the smallest debt first. Once you cross it off your list by paying it off, you’ll start to believe that, yes, you can do this.

Starting With Nothing Of course, what I showed you today was just an example. Now that you see how it works, use your own numbers to draw up your plan for how to get out of debt. And please don’t be discouraged if you find that you have nothing left over after you do the math. I’ve written a few times before about how you can change that. Think about how to save and cut back. It can make a world of difference. Ask yourself questions… Is what you’re about to buy something you want… or something you need? And if it’s something you say you need, then ask yourself why. After a little thinking, you might find that it may not actually be a need after all. Do you have the time (and can you make the effort) to get another job? When’s the last time you asked for a raise? Are there some things you no longer use that you can sell? Are you paying too much for the things you need? At least once a year, shop around for the best price you can get on things like homeowner’s/renter’s insurance and car insurance. The most important thing is not to get discouraged. Even if it doesn’t seem like it at first, there’s always a solution for every problem we face. You don’t need to try to do the impossible. You only need to try… by just doing what you can.

With gratitude,

Melody C. Kerr, MS

Writer, Editor, Financial Coach