There’s something I’ve heard a few times over the past couple weeks that comes at a good time. It’s about mortgages… Just to back up a little bit, in these past few letters, I’ve been talking about the FICO credit score—and more specifically, that it’s not as important as we’ve been told. In short, you don’t actually need to build credit to be able to get approved for a mortgage. And now that we know that—which, if you want to catch up, you can read the letters I wrote on September 19 and October 3—let’s talk about mortgages today and what I’ve been hearing about them lately.

Consider the Cost In separate conversations I’ve had, each person I spoke with mentioned that they want to buy a home in the near future. One of the main factors pushing them in this direction is the cost of renting. Basically, their concern is that renting is just throwing money away. At least you have something to call your own with equity by being a homeowner, right? I don’t necessarily disagree. Many experts in the finance world would say owning a home is a good idea for most people. And I’d say so, too. But owning a home just for the sake of it may not be right for you. Here’s what I mean… Yes… when you rent, your money just goes to your landlord. According to consumer data company Statista, the average rent is around $1,100 per month. And in many areas nearby where I live, in South Florida, $1,100 is a steal if you can get that for just a 1 bedroom, 1 bathroom apartment in a safe neighborhood. So, it’s probably well over $1,100 in many places. Once you pay that $1,100 for the month, that’s it. There’s no investment benefit or anything like that. So, it does sound like throwing money away. On the other hand, when you own a home, there’s something in it for you. Of course, if you are one of the few who would be able to afford to pay all cash for a home, none of what I’m about to say applies. But for the rest of us who’d need a loan, we’re in a way throwing something away, too. According to lending company Rocket Mortgage, the average mortgage payment is between $1,140 and $1,646 per month. Let’s just say you get a mortgage on the lower end that’s comparable to the average rent, say $1,140. It’s $40 more per month than renting. But of course, you do have the deed, and if the home is worth more than you owe, there’s your equity. However, that $1,140 isn’t all going toward paying back what you owe on your mortgage. Remember, when you have a mortgage, you’re not only paying back what you borrowed (the principal), but you’re also paying a “fee” for borrowing in the first place (the interest). The interest is where the money is for lenders. If you do the math, you’ll notice it wouldn’t take you 30 years—or however long the term they give you is—to pay off your mortgage. Let’s say you bought a home for $260,000+ and you put down 20% (highly recommended, by the way, but we’ll get to that next time)… That means you’d owe about $200,000. Now, if your minimum payment is $1,140 on a 30-year mortgage, how long should it take you to pay $200,000 off? Well, there are 360 months in 30 years. So, if you multiply $1,140 by 360 months, that’s over $410,000—more than twice as much as you borrowed. (This isn’t how much you’d actually be paying on a real mortgage. I’m just showing you that if you do the math, it wouldn’t take 30 years to pay off a $200,000 loan.) In a world without paying interest, you’d take about 176 months, or less than 15 years, to pay that off—half the time. Now, with the way mortgages really work, which, as I said, includes interest, by the time the 30-year term is over, based on the typical interest rates right now, you would have paid about $114,500 in interest alone. So, my point here is this: Money is thrown away whether you rent or you own.

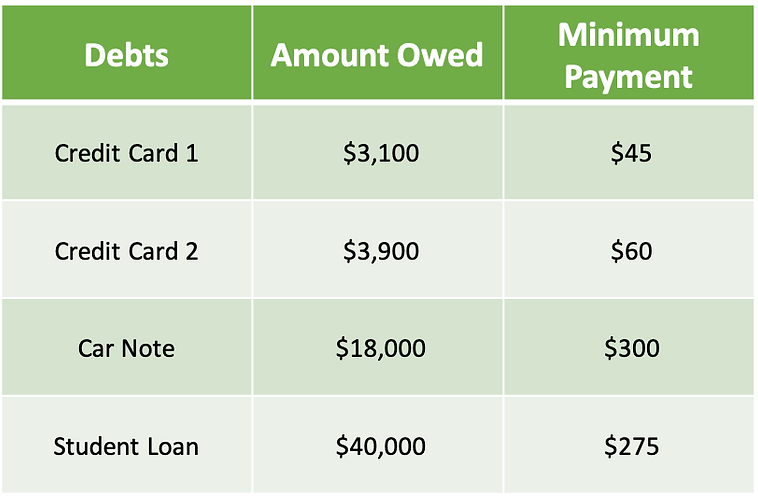

Ready or Not? This isn’t to say you should decide not to own a home. Lenders… landlords… Anyone in the moneymaking business is going to look for ways to make a profit. But what I am saying is, you want to put yourself in the best position possible to be able to afford your mortgage, if that’s the route you take. Think about the typical household’s expenses. Just to name a few, there’s the rent/mortgage, utilities, food, insurance, and transportation. How much easier would it be to live life, especially when unexpected—and costly–things come up, if the only debt you have is your mortgage? So, before you think that owning a home and paying a mortgage is a better bet than renting—and this is very important—think about your other debts first. Also think about how much savings you have. If you have enough saved for the down payment, and enough saved for three to six months of living expenses, in case you lose your job, get a pay cut, or have some sort of expensive emergency, that’s great, too. If you have no debts: no car note, loans, credit card balances, etc., then paying a mortgage on a home that is within your means (we’ll talk about that next time, too), will be much more manageable and way less stressful. All the above will tell you if you’re ready for a home or not. If you do have other debts, you could be spreading yourself too thin. In the last couple issues, I shared an example of what someone’s monthly spending could look like (around $2,830), including their debt list. Looking at this debt list, that’s $680 worth of debt payments per month:

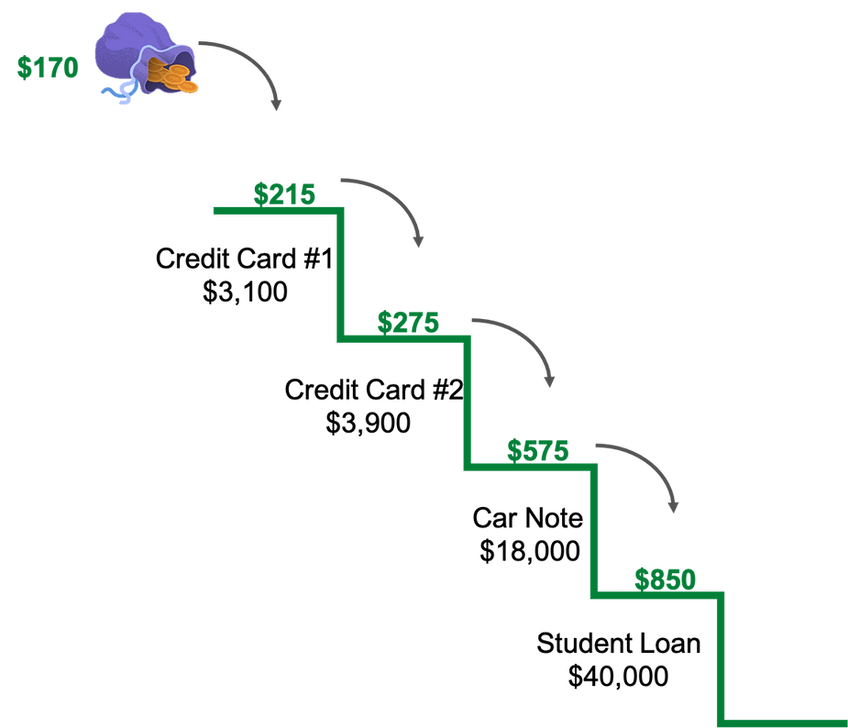

If you’re paying your mortgage, $1,140 every month, and God forbid, you have to change a couple tires… with 680 of your hard-earned dollars going toward debt every month, you have less room to work with to pay for something like that. But if you paid off all those debts and now assume a mortgage with a $1,140 monthly payment, you have $680 you could possibly use to replace your tires or save every month. So, you see, if you don’t bog yourself down… with this debt, that debt, etc., etc., you’ll give yourself a better chance at living a lifestyle that is more affordable for you, less risky, and less stressful. Remember that any kind of debt, including a mortgage, is a risk. You’re telling the lender, “Yes, I can afford to—and will—pay you back by X date.” But none of us knows the future. In an instant, things can change. And suddenly, what you could afford yesterday will put you way in over your head today, tomorrow, and the next day. If you’re thinking about making a down payment on a home, do your best to pay off any other debts first. What to Do I do have to say this, though: Don’t cry over spilt milk. If you’re already in your home, with a mortgage, thinking it’s too late because you did this while you still had other debts… it’s okay. It’s so easy to think: Gosh, I wish I knew this before. But here’s the thing… what’s done is done, and you can’t change anything now. Move forward today with what you can do now. We’ve all made mistakes, done some things out of the “right” order, and missed warning signs we should’ve seen. None of us is perfect. So, don’t beat yourself up. What you can do now is start a “to-do” list. This goes for anyone who’s thinking of buying a home, too. No matter what, the main priority is to build up your savings and pay off your debts. Write up a list of everything you owe and how much. You can make it look like the chart above. Then, add up how much you make and how much you spend each month. After that, focus on saving up $1,000 for an emergency, if you don’t have that saved already. Then, starting with the smallest debt first, put any extra money left every month toward it. Keep repeating that process until you’ve paid off all your debts. As I showed you last month in one of these letters, it’ll look like this for someone who has $170 left over every month:

They’d add $170 to the minimum payment for Credit Card #1, shown in the first chart above ($170 + $45 = $215). And when they’re done paying off Credit Card #1, they’d take the $215 and add it to the minimum they were paying on Credit Card #2 ($215 + 60 = $275). And so on…

If you don’t have anything left to work toward saving $1,000 or paying extra toward your debt, learn how you can try to turn things around by reading “How to Cut Back” and “The Answer to Finding More.” They’re past letters that may encourage you.

Once you pay off all your debts, you’ll take the amount you were using to pay off that final debt (which would be $850 based on the example above), and build up your savings until you have three to six months’ worth of living expenses saved.

By this time, you’ll be motivated by how quickly you can save a lot of money. And in some time, you’ll be saving for that down payment on a home!

As you can see, there are steps to this. But you’re not scaling all the steps at once. Focus on what’s right in front of you. And remember that there’s a time and a place for everything.

Ask yourself if you’re ready. If the answer is no, don’t ever forget… just because this is your situation now, it doesn’t mean it has to stay your situation for good. For every problem, there is a solution.

Don’t decide “I’m not ready” and give up. Sometimes, we all need a friendly reminder that anything worth having requires some work. But the keyword is “worth.” In the end… it is worth it.

Think about that… and just take everything one step at a time.

With gratitude,

Melody C. Kerr, MS

Writer, Editor, Financial Coach